别拘束,就像在自己家一样

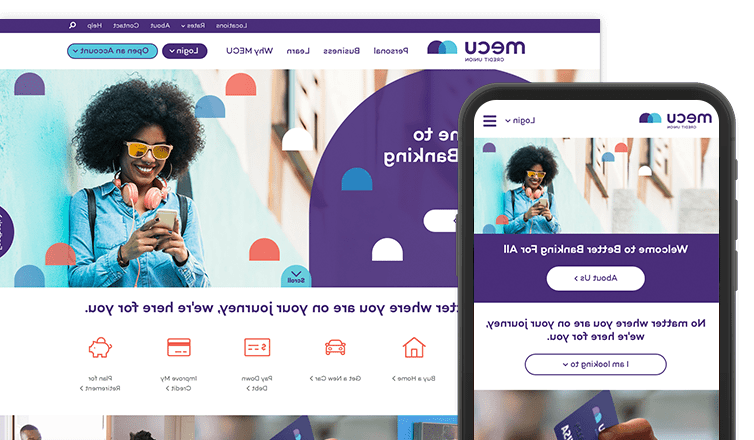

With MECU, your new home is only a few steps away!

We offer a variety of low-cost 抵押贷款 to help you buy your first home, 下一个家, or refinance an existing mortgage. Don't miss out on your dream home. Visit the mortgage resource center and contact us today!抵押贷款

We offer a variety of low-cost 抵押贷款 to help you buy your first home, 下一个家, or refinance an existing home loan.

了解更多房屋净值 Line of Credit

锁定5.99%固定年利率2 for 12 months then as low as Prime minus 0.25%3.

了解更多Mortgage Resource Center (在新选项卡中打开)

Research your various options to find the home loan that fits your budget and lifestyle.

了解更多 (在新选项卡中打开)** MECU will pay the initial closing costs on “Standard” 房屋净值 Lines of Credit. If the line is paid off and closed within 12 months of original note date, closing costs must be reimbursed to MECU by the borrower. Closing costs vary and generally range around $850 to $1,000 on a $20,000 line of credit.